It’s time North Carolina health insurers put patient care over profits.

Watch the Panel Discussion & Download the New White Paper

How Do We Fix Healthcare in North Carolina?

Who we are

What is the North Carolina Center for Health & Democracy?

The North Carolina Center for Health and Democracy examines the status of health care in the state, educating patients, communities, and policymakers about the role health insurance companies have on costs, access, care outcomes, and the long-term sustainability of care for North Carolinians. The Center provides publicly available data, information, and original analysis.

Care Over Greed: Every American should have access to affordable healthcare. But health insurance organizations are denying care in the name of profits.

Stand Up to Misinformation: Expose how health insurers harm Americans by over-charging them, and dictating where patients can receive care.

North Carolinians deserve more from their health insurance companies. Now is the time for North Carolina’s health insurance companies to put patient care over profits – so that we can maintain access to quality healthcare across the state.

North Carolina Healthcare Stats:

- Health insurance denial numbers have left patients with big medical bills and less access to care. An estimated 18% of national in-network claims were denied by health insurance companies in 2020, or about 42.3 million in-network claims, according to data on ACA coverage analyzed by the Kaiser Family Foundation.

- In North Carolina alone, KFF found that 2,901,677 in-network claims were denied in 2020. Furthermore, KFF estimates that only .1% of denied claims are ever appealed and according to national insurance and claims numbers, more than 32% of denied claims were overturned once appealed.

- North Carolina was ranked 39th in the nation by WalletHub in their annual “States with the Best Health Care” survey.

- The state was also ranked 38th in average monthly insurance premium price,

- Two of three “bottom-ranked indicators” were employee insurance costs and high out-of-pocket medical spending.

- North Carolina ranks third in the nation for rural hospital closures.

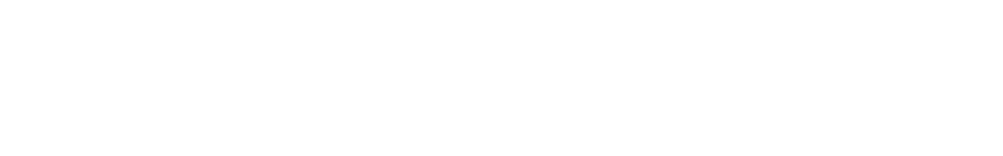

New Study Shows Just 8.3% of North Carolinians Think Health Insurers Have Best Interests in Mind

Meredith Poll recently conduct original research, at the direction of the North Carolina Center for Health and Democracy, exploring North Carolina consumer attitudes about health insurance. They found North Carolinians blame health insurance companies more than any other part of the healthcare system for the rising costs seen in healthcare. While North Carolinians are mostly satisfied with their current health insurance provider, just 8.3 percent feel that their health insurer has their best interest in mind.

The Center for Health and Democracy (CHD) is a non-profit organization led by Wendell Potter that works to transform America’s system of health coverage. The organization’s core belief is that healthcare should be driven not by industry profits, but by the needs and rights of every American to get the quality care they need without concern for cost. Learn more about the Center for Health & Democracy.

In the News

Payors in North Carolina

Profits and Premiums

Health insurance companies are experiencing record revenue and profits coming out of the COVID pandemic. National payors like UnitedHealth Group and CVS/Aetna reported more than $30 billion and $10 billion, respectively in 2021.

North Carolina insurers are no different. The state’s largest insurer, Blue Cross Blue Shield of North Carolina, detailed $10.7 billion in annual revenue in 2021 and almost $570 million in net revenue. WRAL in North Carolina reported that “the top eight executives made an extra $9 million between them.”

Remember, insurance companies largely make profits from unused premiums. With an approximately 60 percent market share in North Carolina, BCBSNC largely controls health insurance premium prices, rate adjustments, and contract negotiations with health care providers. According to North Carolina Department of Insurance, BCBSNC has more than $9 billion in written premiums.

An August 2022 survey by financial services company Aon reports U.S. employers will pay 6.5% more on average for employee healthcare coverage in 2023. According to North Carolina Department of Insurance, BCBSNC tried to boost 2022 individual premiums by nearly 10%, and small group premiums by 6%.

If health insurance companies understand that health care is too expensive, they have not stopped receiving revenue, profits, and pushing rate hikes.

Denials and Appeals

Coming out of the pandemic, health insurance denial numbers have left patients with big medical bills and less access to care. The Kaiser Family Foundation released data this summer on national and state denial rates in 2020 during the pandemic.

An estimated 18% of in-network claims were denied in 2020. For context, that is roughly 42.3 million patients who went to in-network healthcare facilities and were denied coverage. Looking at North Carolina, those denials were in the millions. In North Carolina, 2,901,677 of claims in 2020 were denied.

Most surprisingly is the fact that most denied claims are never appealed despite a decent rate of winning an appeal. The KFF data estimates that only .1% of denied claims are ever appealed and according to national insurance and claims numbers, more than 32% of denied claims were overturned once appealed.

Consumer Confusion

Health care is often confusing and complicated. But where other groups in the health care industry often get hit on unclear data, payors are getting a free pass.

Take a new Forbes Advisor survey that found Americans are confused about their health insurance.

The Forbes survey of 2,000 Americans with health insurance found over three-quarters can’t identify “coinsurance,” and half incorrectly defined copayment and deductible. The survey “also found fairly significant knowledge gaps about open enrollment, Health Savings Accounts and medical billing.”

When paired with the KFF data above, it becomes clear that American’s inability to understand how to navigate their health insurance is resulting in claims being denied and patients paying more for care. After the nation’s largest health plans continue to see record profits, this issue is of great importance to North Carolinians.

Legal, Regulatory, and Payment Disputes

An older North Carolina couple switched from the state insurance exchange plan to Medicare after the husband turned 65-years-old.

“When Blue Cross switched Melissa to her new exchange plan, Jim says, the insurer determined that the amount she had paid toward her deductible would not roll over to her new plan. The couple had already paid her 2019 individual deductible of $6,750. Faced with the need to start over again, she would have to pay another $6,750 before her insurance coverage kicked in later this year.”

The mandate that requires insurers to post the amounts they pay to healthcare clinicians for the services they provide to patients, the second part of a federal transparency ruling issued in October 2020, is live.

Insurers were given a 12-month lead and an extension to have price transparency numbers ready by July 2022.

The data that has been shared from insurers has been called everything from a “data dump” to being “inaccessible to mere mortals,” with load times of up to five minutes on one insurer’s website and more than 45,000 entries.

Per the New York Times, “The nation’s Blue Cross plans have reached a tentative $2.7 billion settlement in a federal lawsuit filed by their customers that accuses the group of engaging in a conspiracy to thwart competition among the individual companies…”

“One in three Americans is covered by a Blue Cross plan, and these plans are often the largest health insurer in their respective state or region.”